Exclusive eBook

Discover Why car collectors

are choosing real estate investments

Scroll Down To Access the eBook

Key Points Covered in the eBook

Table Of Contents

- Introduction

- The Car Collector’s Mindset – Precision, Value, and Legacy

- Insights For Car Collectors- Car Collecting: How to Protect Your Investment

- Building Wealth That Matches Your Lifestyle

- Multifamily Investing – A Foundation for Long-Term Wealth

- Multifamily Strategies for Car Collectors

- From Passion to Legacy – Building Wealth That Lasts

- Conclusion

- Intro

- Chapter 1

- Chapter 2

- Chapter 3

- Chapter 4

- Chapter 5

- Chapter 6

- Conclusion

Introduction: The Unique Mindset of Car Collectors: Passion, Precision, and Perfection

Car collectors are not just enthusiasts; they are curators of history, craftsmanship, and passion. The pursuit of rare automobiles isn’t driven solely by the thrill of ownership—it’s about the connection to something bigger, something that transcends time. It’s a pursuit of precision, value, and legacy.

Whether you’re collecting classic Ferraris, vintage Porsches, or limited-edition collectibles like the 1963 Chevy Corvette, 1970 Chevelle SS Convertible LS6, or 1997 McLaren F1, every decision you make reflects a unique mindset. Car collectors are known for their meticulous attention to detail and their ability to spot hidden gems that others may overlook. They understand that value doesn’t just come from the price tag—it’s about the story behind each vehicle, the rarity it holds, and its potential to appreciate over time.

This mindset is more than just about collecting cars; it’s about building something that lasts—something that not only brings personal joy but can also be a solid investment for the future. In this ebook, we’ll show you how real estate investing can align perfectly with your passion for cars, giving you the financial foundation to continue growing your collection, protecting your assets, and building generational wealth.

The Car Collector’s Mindset – Precision, Value, and Legacy

The Parallels Between Collecting Rare Cars and Building Wealth

At its core, the mindset of a car collector shares many similarities with that of successful wealth builders. Both require a keen eye for value, a deep appreciation for craftsmanship, and a long-term perspective. Just as a collector evaluates a rare automobile for its potential to appreciate in value, so too do investors assess assets—be they cars or real estate—based on their potential to grow over time.

In the world of multifamily real estate investing, much like with car collecting, there are key factors to consider: rarity, condition, historical significance, and the story behind the asset. When choosing cars or real estate, you aren’t simply looking for something to acquire; you’re looking for something that will appreciate and yield long-term returns.

- Rarity: Whether it’s a limited-edition Ferrari or a multifamily property in an emerging market, rarity drives value. Just like finding a one-of-a-kind car, identifying rare investment opportunities is essential.

- Condition and Craftsmanship: A well-maintained, original car will always fetch more than a restoration or a rushed modification. Similarly, investing in well-located, well-maintained properties with a solid rental history often leads to better returns.

- Long-Term Appreciation: Cars like the Ferrari 250 GTO or McLaren F1 have appreciated significantly over time. Similarly, multifamily properties tend to increase in value as they generate consistent cash flow and grow in demand, especially in the right markets.

Understanding Appreciating Assets

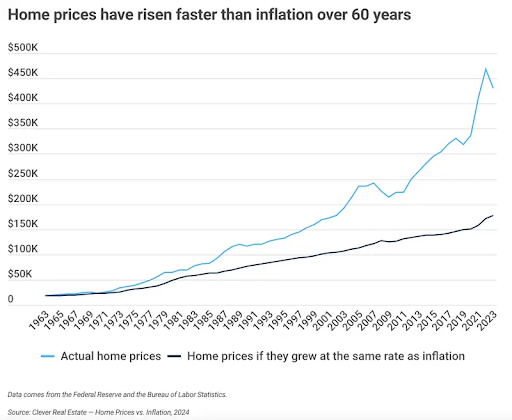

The concept of appreciating assets is central to both the world of car collecting and real estate investing. Unlike cars that depreciate with regular use, real estate generally appreciates over time, especially in high-demand markets. For car collectors, investing in a vehicle is about holding onto something that grows in value—the same goes for real estate.

Here’s how the idea of appreciation works in both worlds:

- Cars: Rare, well-maintained cars become appreciating assets because their scarcity, historical significance, and craftsmanship increase in value as time goes by. Vintage cars, such as the Ferrari 250 GTO, have shown record-breaking increases in value because there are only a few left in pristine condition.

- Real Estate: Multifamily properties have similar appreciation potential, especially when located in high-demand areas with strong population growth, job opportunities, and limited housing supply. Real estate doesn’t just hold its value—it grows it. Over time, a well-located multifamily building can increase in value through rising rents, property improvements, and the overall development of the surrounding area.

For car collectors, the key to success lies in knowing which cars will appreciate and ensuring they are well-maintained. The same applies to real estate investors—understanding which markets and properties have the best chance of appreciating requires diligent research, careful selection, and long-term planning.

Insights For Car Collectors- Car Collecting: How to Protect Your Investment

For many car enthusiasts, collecting rare vehicles isn’t just a passion—it’s a profitable investment. The 2023 North American auctions saw seven cars sell for over $10 million each, with the total sales surpassing $3.4 billion. With even higher numbers expected in 2024, it’s clear that car collecting is big business.

However, like any significant investment, protection is key. The market for high-end collectibles is thriving, but it’s essential to ensure that you’re safeguarding your assets properly. This chapter will guide you through the steps to not only protect your car collection but also make smart decisions that ensure its value appreciates over time.

What Qualifies a Car as a Collectible?

Understanding what makes a vehicle collectible is the first step in protecting and growing your investment. Generally, cars that are rare, carry an influential name, or have limited production numbers are deemed collectible. The rarity factor is a crucial determinant—whether it’s a model that’s hard to find or a car that holds historical significance, rarity can dramatically increase a car’s value.

The Most Promising Vehicles for 2024-25

Experts have highlighted several vehicles poised for significant appreciation. Here are some top picks for potential future value:

- McLaren F1: Known as “the next Ferrari 250 GTO,” this iconic car could fetch more than $20 million, given its limited availability.

- Chevrolet Corvette (1963-1967): A classic American car that continues to gain momentum.

- Subaru Impreza RB320: A highly sought-after model due to its production scarcity, expected to hit the $100K+ mark.

- Ferrari, Chevrolet Corvette, and Aston Martin GT2 Models: Popular models with growing demand in auctions.

Just like the cars listed above, choosing the right real estate properties for investment is critical for building wealth. Similar to rare cars, certain real estate markets and properties will appreciate more than others, providing you with greater long-term financial returns.

Here are 5 promising real estate markets to watch for 2024-25:

- Tech Hubs and High-Growth Cities: Areas with booming job markets and tech developments are expected to show strong appreciation. Austin, Phoenix and Atlanta continue to attract significant investment due to their strong tech sectors and growing job opportunities.

- Suburban Areas Near Major Urban Centers: As remote work continues, suburban areas near large cities are becoming hot investment spots. Phoenix, Raleigh, and Dallas-Fort Worth are seeing rapid suburban growth, with increasing demand for housing and office spaces.

- College Towns: These markets often offer stability and growing demand, especially in multifamily properties. Cities like Athens, GA, and College Station, TX, boast strong student populations, consistent rental demand, and long-term investment potential.

- Key Markets: With growing populations and job growth, cities in the key markets are a strong investment opportunity. Areas like Phoenix, Charlotte, and Atlanta are benefiting from low taxes, favorable climates, and an influx of new residents.

- Affordable Housing Developments: There’s increasing demand for affordable housing in areas with population growth and low vacancy rates. Orlando, Indianapolis, and Detroit are seeing a rise in affordable housing projects as demand outpaces supply in these growing regions.

By identifying these high-growth areas and focusing on quality properties, investors can create wealth and security, just like collectors seeking rare vehicles with high potential for appreciation.

How to Safeguard Your Collector Car Investment

Now that you know which vehicles have the potential to appreciate, it’s time to understand how to protect them. A standard auto insurance policy won’t offer the coverage you need if something goes wrong. Unlike regular vehicles, collector cars should be insured with a specialized collector car policy. Here’s why:

- Guaranteed Value Insurance: Unlike a standard policy that may only cover your car’s depreciated value, guaranteed value insurance ensures you get the full amount for your car, with no depreciation applied in the event of a loss. This is crucial because the market value of your collector car may far exceed what a regular auto policy would pay out.

- Cheaper Coverage with Better Protection: Collector car policies are often less expensive than traditional auto insurance. Since collector cars aren’t driven daily, you shouldn’t be paying full premiums for regular-use vehicles. These specialized policies are tailored to your unique needs, giving you more comprehensive protection without the high cost.

- Avoiding Stated Value Policies: A stated value policy can be misleading, as it doesn’t guarantee full compensation in case of loss. Insurers can either provide the car’s depreciated value or the cost of replacement, whichever is lower. With guaranteed value insurance, you’re ensuring that your car’s value is fully protected.

In the same way that specialized insurance safeguards your collector car investment, WestKey Capital safeguards your real estate investments. At WestKey Capital, we focus on strategic, high-value properties that provide strong passive income streams and long-term wealth. Our approach ensures your investment is well-protected and aligned with your wealth-building goals, just like securing your cars with the right insurance.

Whether you’re investing in multifamily real estate or building your car collection, it’s crucial to choose wisely, protect your assets, and build generational wealth that lasts for years to come.

Building Wealth That Matches Your Lifestyle

As a high-net-worth car collector, you’ve likely already built an impressive collection of rare automobiles. But just as you carefully curate each car in your collection, it’s equally important to diversify your wealth—to ensure that your financial portfolio reflects the same precision, value, and legacy that you apply to your passion for cars.

Why High Net Worth Car Collectors Prioritize Wealth Diversification

Car collectors understand that diversification is key to preserving and growing wealth. Much like you wouldn’t rely on a single car model to define your entire collection, you shouldn’t rely on just one investment strategy to secure your financial future. Diversification spreads risk and maximizes your potential for consistent growth.

By including real estate in your portfolio, you’re adding an asset class that complements the appreciation and income potential of your collection. Real estate investments, especially multifamily properties, offer stable cash flow, capital appreciation, and long-term value growth, making them an ideal choice for high-net-worth individuals who are passionate about both luxury cars and smart investing.

Wealth Without Compromise: Investing Smartly While Pursuing Your Passions

One of the most powerful aspects of multifamily real estate investing is that it allows you to build wealth without compromising your lifestyle. Just as you carefully choose cars that match your tastes and vision, you can curate real estate investments that align with your long-term goals.

By leveraging real estate as a tool to grow and protect your wealth, you can continue pursuing your love for rare cars, attending exclusive auctions, and even funding the expansion of your collection—all while enjoying passive income and consistent returns from your real estate investments.

Multifamily properties, in particular, offer the opportunity to generate reliable, passive income, which can be reinvested into your car collection or other luxury pursuits. This allows you to maintain and expand your passions without the stress of worrying about your financial future.

Role of Multifamily Investing in Creating a Passive Income Stream

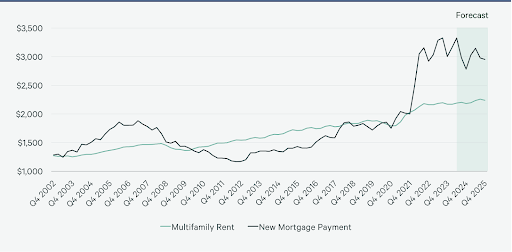

As a car collector, your passion lies in rare, appreciating assets—not in managing complex investments. You need a way to build wealth, support your lifestyle, and protect your collection without the stress. Multifamily real estate provides a reliable, steady cash flow through rental income, independent of stock market volatility.

But you’re not looking to do it all yourself. You want high returns without the hassle of managing properties. That’s where WestKey Capital steps in. We offer a done-for-you solution, handling everything from property acquisition to management, ensuring maximum returns with minimal effort on your part.

With WestKey, you can leverage our expertise and scale advantages to invest in larger, high-return properties while enjoying the passive income stream and benefits—letting you focus on what you love, without the worry.

Multifamily Real Estate Investing – A Foundation for Long-Term Wealth

Multifamily real estate has long been considered a cornerstone of wealth-building for savvy investors. But what makes multifamily properties such a solid choice for car collectors? And why should they be an integral part of your investment strategy?

The Fundamentals of Multifamily Real Estate Investing

At its core, multifamily real estate investing involves the purchase of properties with multiple units, such as apartment complexes or townhouses, with the goal of generating income through rent. But beyond the basics, there are key advantages that make multifamily properties stand out:

- Cash Flow: Each unit you own can provide consistent rental income, creating a reliable cash flow stream that helps you build wealth.

- Appreciation: Over time, multifamily properties tend to appreciate in value, especially in growing or high-demand areas.

- Tax Benefits: Real estate investments come with significant tax advantages, including depreciation and 1031 exchanges, which allow you to defer taxes and increase your investment’s overall return.

Why Multifamily Investing Complements the Lifestyle of Car Collectors

The car collector’s lifestyle is all about luxury, precision, and long-term vision. Multifamily real estate investing aligns perfectly with this mindset because it offers a long-term, stable investment that doesn’t require constant attention. Just as your car collection grows over time and increases in value, so does your multifamily investment portfolio.

Multifamily properties, much like your car collection, become valuable assets over time. As your investments appreciate and generate passive income, you can use the returns to support your passion for collecting, expanding your portfolio, or investing in other areas that further enhance your lifestyle.

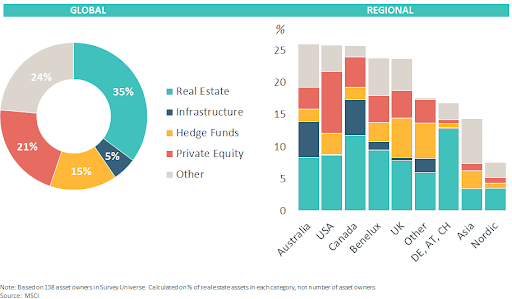

Why Multifamily is a Preferred Asset Among Successful Collectors

Successful car collectors understand that collecting is about more than just acquisition—it’s about growing and preserving value. Multifamily real estate offers the same opportunity to build wealth over time. Unlike stocks or bonds, which are often volatile and short-term, multifamily properties provide long-term stability and predictable cash flow.

Many of the world’s wealthiest individuals have made multifamily real estate investments an integral part of their wealth-building strategies. The stability and growth potential of multifamily properties make them a preferred asset class, particularly for those who understand the importance of diversification and financial independence.

How Multifamily Generates Passive Income and Preserves Wealth

One of the greatest advantages of multifamily real estate is its ability to generate passive income. Whether you’re investing in a small apartment building or a large multifamily complex, you can benefit from monthly rental income that requires minimal time or effort once the property is acquired and properly managed.

Moreover, multifamily properties are inflation vs real estate or multifamily—they tend to outperform other asset classes during economic downturns, preserving wealth and providing consistent returns. As a car collector, this means you can focus on growing your collection, knowing that your real estate investments are working for you in the background, building wealth and preserving your assets.

Multifamily Strategies for Car Enthusiasts

As a car enthusiast, you’ve likely honed a keen ability to spot value, whether in a rare vintage Ferrari or a hidden gem in a car auction. The same discerning eye you use to evaluate collectible cars can be applied to multifamily real estate investments. In this chapter, we’ll explore strategies that will allow you to invest like a pro, leveraging the same precision and foresight that have served you well in your passion for cars.

Investing Like a Pro: Multifamily Real Estate Strategies Tailored for Car Collectors

Much like curating a collection of rare cars, investing in multifamily real estate requires a strategic approach. Here are some key strategies that can help you build wealth while maintaining the lifestyle you love:

- Focus on Appreciation and Cash Flow: Just as you look for cars that will appreciate in value over time, the same applies to multifamily properties. Focus on areas with strong job growth, population growth, and rising rent demands. The combination of appreciation and cash flow can provide both short-term returns and long-term wealth accumulation. Recent Stats: According to CBRE’s 2025 Multifamily Outlook, rents are expected to grow by 2.2% in 2025, fueled by strong demand and low supply in key markets,

- Leverage the Power of Tax Benefits: Just like purchasing cars with tax advantages (e.g., sales tax savings on certain vehicles), multifamily real estate offers significant tax incentives, such as depreciation, 1031 exchanges, and cost segregation. These strategies allow you to defer taxes and maximize your returns, ensuring that more of your rental income stays in your pocket.

- Diversification with Multifamily: As a car collector, you likely have a diverse collection—mixing classic cars, modern vehicles, and rare finds. Similarly, multifamily real estate offers an opportunity to diversify your wealth and reduce risk. Investing in a range of properties—across different regions or asset classes—can help protect you against economic volatility while ensuring consistent returns.

- Partnering for Bigger Projects: You don’t have to go it alone. Partnering with other investors allows you to acquire larger, more lucrative properties that you may not be able to afford on your own. Just like pooling resources to buy rare cars at auctions, teaming up with others in the real estate world can lead to even greater success.

Real Stories: Successful Investors Who Collect Cars and Build Real Estate Portfolios

- Case Study 1: A well-known car collector who built a multi-million-dollar multifamily portfolio by purchasing undervalued properties in growing cities. By focusing on properties with strong rental demand and adding value through renovations, this investor achieved an impressive 15% annual return on their multifamily investments.

- Case Study 2: Another car enthusiast combined his love for rare cars with real estate by purchasing properties in luxury markets and turning them into high-end short-term rentals. This unique strategy allowed him to generate substantial passive income, which he used to fund his car collection and other luxury assets.

From Passion to Legacy – Building Wealth That Lasts

As a car collector, you’re already building a legacy of fine automobiles, but why stop there? Building wealth that lasts requires a strategy that preserves both your collection and your financial security for future generations.

Preserving Both Your Car Collection and Wealth for Future Generations

Your collection is more than just cars; it’s a reflection of your passion and your values. Similarly, your wealth should be protected and passed down. Real estate investing offers a solid foundation for building generational wealth, which you can continue to grow and pass on to your heirs. By diversifying into multifamily properties, you not only safeguard your wealth but also ensure that your family can continue to benefit from it long after you’re gone.

Balancing a Portfolio: Ensuring Your Investments Support – Not Limit – Your Lifestyle

Building a balanced portfolio means choosing assets that complement your lifestyle rather than hinder it. Your car collection is an expression of your passion, and your real estate investments should align with that—providing consistent cash flow, long-term value, and financial freedom. With multifamily real estate, you can enjoy the benefits of both appreciating assets and reliable passive income streams. This allows you to continue expanding your car collection and pursuing your passions without compromise.

Why Car Collectors Should Consider Multifamily Real Estate as Part of Their Wealth Strategy

As a car enthusiast, you already understand the value of curating a collection that will stand the test of time. Just like carefully selecting each rare vehicle, your investment strategy should be focused on assets that appreciate and provide long-term value. Multifamily real estate offers just that—a smart, stable, and profitable asset to complement your passion for cars.

By incorporating real estate investing into your wealth strategy, you can generate passive income to fund your car collection, ensure the long-term growth of your assets, and build a legacy of wealth that will last for generations. With multifamily properties, you can diversify your investments, preserve wealth, and maintain the lifestyle you’ve worked so hard to create.

WestKey Capital, led by Jim Stuart, a seasoned investor and lifelong car collector lover , understands the importance of blending passion with smart investment strategies. Jim has successfully built a multimillion-dollar portfolio of multifamily properties while fueling his love for rare automobiles. With WestKey Capital, you can join a community of like-minded car enthusiasts who are using real estate to fuel their passion, build generational wealth, and secure financial freedom.

With WestKey Capital, you can drive your wealth forward—from building your collection to securing a legacy of financial success. Let’s hit the road to financial freedom together.